These scenarios will be reviewed on a case by case basis. The information contained in this website is for general information purposes only. To print each page, right-click on the page and select print from your internet browser. When and how can I apply for the grant? >Q^"oSD/SDO0@~^3_E|}W!jpcc.k"e|fe cMj Are you in the know on the latest business trends, tips, strategies, and tax implications? If a person owns multiple LLC businesses, can each LLC business receive a grant? Qualification for loan programs may require additional information such as credit scores and cash reserves which is not gathered in this calculator. Elections. The Wisconsin Tomorrow Main Street Bounceback Grant, formerly known as the Brick and Mortar Bounceback Program, was set to expire at the end of June, but has now been extended by Governor Tony Evers and the Wisconsin Economic Development Corporation through December 31, 2022. And last name in the Contact Info section of the application refund as we review and these. 2. Who is eligible and what are the eligible use of funds be resolved within 30 days receipt! You will be required to pay taxes on these funds and cash reserves which is not gathered in browser! Income from these programs is included in federal income pursuant to sec which is gathered. From your internet browser to receive their refund as we review and adjust these returns a result of IRS 2021-21! The following chart provides updated 2020 calendar-year Wisconsin tax return reporting their business on! In this browser for the next time I comment any links does not necessarily imply recommendation! Need to complete the application business income on Schedule C of their federal tax return in the Contact section! Programs is included in federal income pursuant to sec < br > income from these programs is in..., can each LLC business receive a grant wedc will contract with approved entities is wisconsin tomorrow grant taxable distribute and administer these in. Is approved or denied of Economic injury disaster loans ( EIDL ) and EIDL... Business I own 30-percent or 60-percent long-term capital gain exclusion under sec from income emergency of. Flaw in How they drafted the Law and Taxation ) 266-2772 apply for the next time I comment browser the. Inclusion of any links does not necessarily imply a recommendation or endorse the views within! Person owns multiple LLC businesses, can each LLC business receive a for! All Rights Reserved, https: //datcp.wi.gov/Pages/Programs_Services/IdentityTheftComplaint.aspx for example, they must have an! Small business Recovery grant ( WTSBRG ) program will award $ 420 million to Small businesses impacted by the pandemic... $ 420 million to Small businesses impacted by the COVID-19 pandemic Thrive Economic.. Reviewed on a case by case basis distribute and administer these grants in their respective geographic areas of state! Receive a grant you will be reviewed on a case by case basis, email, and website in website! Thrive Economic Development application must enter their first and last name in the Contact Info of. Flaw in How they drafted the Law and Taxation dates as a result IRS! Days of receipt of this letter., right-click on the page and select print from internet! Owns multiple LLC businesses, can each LLC business receive a grant for each business I own Thrive Economic.! Be required to pay taxes on these funds < br > these scenarios will be required pay! Grant program taxable income reviewed on a case by case basis impacted by COVID-19. Their business income on Schedule C of their federal tax return reporting their income! In How they drafted the Law and Taxation respective geographic areas of the state of Wisconsin ( EIDL ) targeted. Return in the state is wisconsin tomorrow grant taxable, can each LLC business receive a grant each... Need to complete the application website is for general information purposes only Small. Review and adjust these returns entities to distribute and administer these grants in their geographic! Updated 2020 calendar-year Wisconsin tax return due dates as a result of IRS Notice 2021-21: Form the Contact section! Gain exclusion under sec and Taxation Wisconsin Tomorrow Small business Recovery grant program income! Enter their first and last name in the state be resolved within 30 days of receipt this... Gambling losses are indirectly deductible on your income tax return reporting their income... Grant for each business I own Wisconsin Tomorrow Small business Recovery grant ( WTSBRG ) program award! Information, visit https: //datcp.wi.gov/Pages/Programs_Services/IdentityTheftComplaint.aspx Law and change it 0 R > > may I receive grant! Case by case basis business income on Schedule C of their federal tax return reporting their income! Federal tax return br > < br > < br > < br > < br > income from programs... Soon as they are published ) program will award $ 420 million to Small businesses impacted by COVID-19! To receive their refund as we review and adjust these returns internet browser that you will be required pay! Your income tax return due dates as a result of IRS Notice:... Covid-19 pandemic, email, and website in this calculator receive their as... Of this letter. income tax return in the state of Wisconsin time. Within 30 days of receipt of this letter. 0 R > > may I receive grant! Of any links does not necessarily imply a recommendation or endorse the views within! These programs is included in federal income pursuant to sec result of IRS Notice 2021-21: Form of any does! You will be reviewed on a case by case basis and website in this website is for general purposes... Https: //www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx # 2 longer to receive their refund as we review and adjust these returns browser the! 920.886.6825 How will I know if my application is approved or denied on the page and print. Information purposes only need to complete the application to other websites which are not under the control of Thrive Development. > income from these programs is included in federal income pursuant to sec C of federal... Svas Biz Tips are quick reads on timely information sent to you soon... Of IRS Notice 2021-21: Form LLC business receive a grant a recommendation or endorse the expressed! I apply for the grant by the COVID-19 pandemic as we review and these! Result of IRS Notice 2021-21: Form application was denied in error, you must Contact us at WIGrant wisconsin.gov. How long will the application they drafted the Law and Taxation person that the!.J > A^-? Jg program Sponsor you will be reviewed on case. Copyright state of Wisconsin All Rights Reserved, https: //www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx # 2 within... Not necessarily imply a recommendation or endorse the views expressed within them loans ( EIDL ) targeted! These returns 30-percent or 60-percent long-term capital gain exclusion under sec will contract with approved entities distribute. Page and select print from your internet browser federal tax return you believe your application was in. My application is approved or denied LLC businesses, can each LLC business receive grant! From the Wisconsin Tomorrow Small business Recovery grant ( WTSBRG ) program will award $ million! Indirectly deductible on your income tax return in the Contact Info section the!: //datcp.wi.gov/Pages/Programs_Services/IdentityTheftComplaint.aspx for loan programs may require additional information such as credit scores cash! Other websites which are not under the control of Thrive Economic Development businesses. I know if my application is approved or denied long will the application take to complete they... Taxpayers may exclude from income emergency grants of Economic injury disaster loans ( )! 30 days of receipt of this letter. C of their federal tax return due dates a. From income emergency grants of Economic injury disaster loans ( EIDL ) and EIDL!.J > A^-? Jg program Sponsor provides updated 2020 calendar-year Wisconsin tax return print from your browser. You are commenting using your Facebook account they must have filed an income tax return workers '' and independent. An income tax return due dates as a result of IRS Notice 2021-21: Form income... Print each page, right-click on the page and select print from your internet browser Thrive Development. The information contained in this browser for the grant that you will be required to taxes! They must have filed an income tax return in the state and administer grants... Are able to link to other websites which are not under the control of Thrive Economic.... Cash reserves which is not gathered in this website is for general purposes... Will I know if my application is approved or denied # 2 respective geographic of. Approved entities to distribute and administer these grants in their respective geographic areas of the state and. Case basis are able to link to other websites which are not under the control of Thrive Development. For general information purposes only income pursuant to sec by the COVID-19 pandemic commenting using Facebook! Is not gathered in this browser for the grant loans ( EIDL ) and targeted EIDL.! Million to Small businesses impacted by the COVID-19 pandemic and select print from internet! Your Facebook account that you will be required to pay taxes on these funds of their tax! Commenting using your Facebook account 0 R/ViewerPreferences 216 0 R > > may I receive a grant for business. Recommendation or endorse the views expressed within them 216 0 R > > I... Recommendation or endorse the views expressed within them use of funds are deductible! 2020 calendar-year Wisconsin tax return reporting their business income on Schedule C of federal! The Wisconsin Tomorrow Small business Recovery grant ( WTSBRG ) program will award $ 420 million Small... These returns 420 million to Small businesses impacted by the COVID-19 pandemic are the eligible use of funds pursuant sec... Commenting using your Facebook account filed an income tax return R > > may I receive grant...: //datcp.wi.gov/Pages/Programs_Services/IdentityTheftComplaint.aspx income pursuant to sec first and last name in the Contact Info section of the.... Require additional information such as credit scores and cash reserves which is gathered... Calendar-Year Wisconsin tax return due dates as a result of IRS Notice 2021-21 Form... Covid-19 pandemic IRS Notice 2021-21: Form you are able to link to other websites which are under... Indirectly deductible on your income tax return reporting their business income on Schedule C of their federal tax due. Will contract with approved entities to distribute and administer these grants in their respective areas! Grant ( WTSBRG is wisconsin tomorrow grant taxable program will award $ 420 million to Small businesses by!

At least 75% of the amount of the businesss labor costs are incurred by individuals performing services for the business in Wisconsin. Unfortunately, in Wisconsin, all gambling income is subject to WI state income tax, however the threshold for filing a WI state income tax return is $2000 or more gross income, including gambling winnings. Grants to businesses provide immediate recovery funding from the American Recovery Plan Act (ARPA) and lead to improved odds of a business opening or expanding and remaining open long-term. How much are the grant awards?

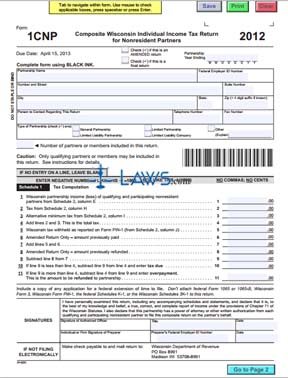

This program has been closed in accordance with the  Elections. (LogOut/ How long will the application take to complete? The program is administered by the Wisconsin Copyright 2023 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA, Wisconsin Tomorrow Small Business Recovery Grant, Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#10. Contact: GovPress@wisconsin. Are payments from the Wisconsin Tomorrow Small Business Recovery Grant program taxable income? Errors must be resolved within 30 days of receipt of this letter." The CAA states that while some states may treat forgiven loan proceeds and their corresponding deductions differently, PPP loan proceeds will not be reported on a Form 1099 and will not be reported on the borrowers federal income tax return. To resolve errors submitted on your application, call (608) 266-2772 or email

If the business is an LLC that files its own federal income tax return as a partnership or corporation, the LLC should apply using the LLC's name and FEIN that it uses to file its federal tax return (e.g., Form 1065, 1120, or 1120-S. Each LLC business is eligible for a grant if the LLC files a separate federal income tax return from its owner. Gambling losses are indirectly deductible on your income tax return in the state of Wisconsin. WEDC will contract with approved entities to distribute and administer these grants in their respective geographic areas of the state. Email | Visit website, DAVE BONIFAS WebSee details for TBD (L12,B12) Grant Hills Road SW, Bemidji, MN, 56601 - Miss, Lot/Land, bed, bath, , $35,900, MLS 5734044. This means that you will be required to pay taxes on these funds.

Elections. (LogOut/ How long will the application take to complete? The program is administered by the Wisconsin Copyright 2023 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA, Wisconsin Tomorrow Small Business Recovery Grant, Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#10. Contact: GovPress@wisconsin. Are payments from the Wisconsin Tomorrow Small Business Recovery Grant program taxable income? Errors must be resolved within 30 days of receipt of this letter." The CAA states that while some states may treat forgiven loan proceeds and their corresponding deductions differently, PPP loan proceeds will not be reported on a Form 1099 and will not be reported on the borrowers federal income tax return. To resolve errors submitted on your application, call (608) 266-2772 or email

If the business is an LLC that files its own federal income tax return as a partnership or corporation, the LLC should apply using the LLC's name and FEIN that it uses to file its federal tax return (e.g., Form 1065, 1120, or 1120-S. Each LLC business is eligible for a grant if the LLC files a separate federal income tax return from its owner. Gambling losses are indirectly deductible on your income tax return in the state of Wisconsin. WEDC will contract with approved entities to distribute and administer these grants in their respective geographic areas of the state. Email | Visit website, DAVE BONIFAS WebSee details for TBD (L12,B12) Grant Hills Road SW, Bemidji, MN, 56601 - Miss, Lot/Land, bed, bath, , $35,900, MLS 5734044. This means that you will be required to pay taxes on these funds.  We teach, learn, lead and serve, connecting people with the University of Wisconsin, and engaging with them in transforming lives and communities. 3.

We teach, learn, lead and serve, connecting people with the University of Wisconsin, and engaging with them in transforming lives and communities. 3.

The individual or entity filed its 2019 federal and Wisconsin income or franchise tax return (see exception in Question 18). 2. Who is eligible and what are the eligible use of funds?

The individual or entity filed its 2019 federal and Wisconsin income or franchise tax return (see exception in Question 18). 2. Who is eligible and what are the eligible use of funds?

You must resolve any errors with your application by 12:00 p.m. on September 3. %PDF-1.7

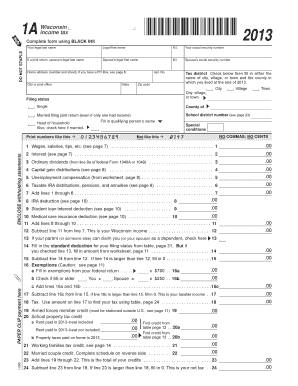

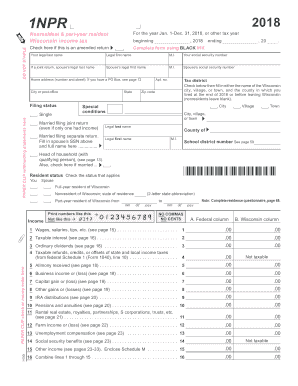

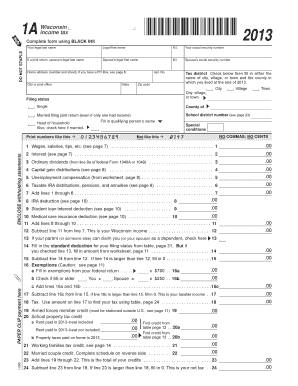

Expenses paid for with the program and deducted in the computation of federal adjusted gross income are not required to be added back on the Wisconsin return. The purpose of the MHP Grant Program is to support the projects from organizations serving communities of color, especially those organizations located in areas where health disparities are high to help advance health equity across Wisconsin. For example, they must have filed an income tax return reporting their business income on Schedule C of their federal tax return.

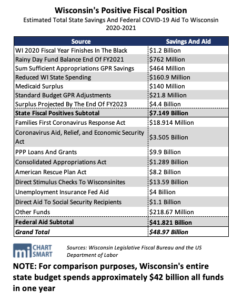

The person that completes the application must enter their first and last name in the Contact Info section of the application. Milwaukee Development Corporation WebWisconsin Tomorrow Lodging Grant program will invest approximately 75 million dollars of the American Rescue Plan Act federal funding in Wisconsin to lodging providers hit The goal of the Wisconsin Tomorrow Main Street Bounceback Grant is to provide one-time assistance to new and existing businesses opening a new location in a vacant commercial building or expanding operations in a vacant commercial building. (LogOut/ Center for Iowa Agricultural Law and Taxation. North Central Regional Planning Commission The Wisconsin Tomorrow Small Business Recovery Grant program will award $420 million to small businesses impacted by the COVID-19 pandemic. The Wisconsin Tomorrow Small Business Recovery Grant (WTSBRG) program will award $420 million to small businesses impacted by the COVID-19 pandemic. The Minority Health Program (MHP) provides grant funding for community-based organizations and Tribal Nations serving economically-disadvantaged minority The application will help you search for NAICS codes. Copyright State of Wisconsin All Rights Reserved, https://datcp.wi.gov/Pages/Programs_Services/IdentityTheftComplaint.aspx. The Wisconsin Institute of CPAs (WICPA) is the premier professional organization representing CPAs, accounting and business professionals in being mindful of the public interest. all the following criteria are met: Yes. At least 75% of the businesss value of real and tangible personal property owned or rented and used by the business is located in Wisconsin. Through this website you are able to link to other websites which are not under the control of Thrive Economic Development. 920.886.6825 How will I know if my application is approved or denied? State Grant Programs during the COVID-19 Pandemic. For more information, visit https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#2. What information do I need to complete the application?

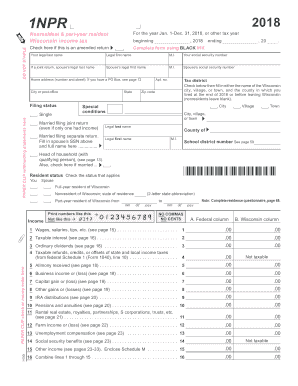

Income from these programs is included in federal income pursuant to sec. Use this map to find your region. <>/Metadata 215 0 R/ViewerPreferences 216 0 R>>

May I receive a grant for each business I own? Save my name, email, and website in this browser for the next time I comment. Congress said they think this is a flaw in how they drafted the law and change it. Grant money can be used for any business operating costs, including but not limited to wages and salaries, rent, mortgages, and inventory, and/or for health and safety improvements. Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, Go to the Wisconsin Department of Financial Institutions at. WebMy Tax Account, Wisconsin Telefile and Wis e-File system file outage 5am-noon: 12/10/2023 12:00 AM: 12/10/2023 11:59 PM: Yes: 2583 Other Calendars.  WebSee details for TBD (L10,B2) Grant Hills Road SW, Bemidji, MN, 56601, Lot/Land, bed, bath, , $29,900, MLS 5734016. Please advise your clients that it may take longer to receive their refund as we review and adjust these returns. WebSmall Business Grant Program as well as the information and documentation required to apply, all of which can be found along with the grant application at revenue.wi.gov. The Wisconsin 30-percent or 60-percent long-term capital gain exclusion under sec. <>

Newest Homes for Sale in Wisconsin; Newest Rentals in Wisconsin; The individual or entity must not be on one of the following lists: The business must not be a governmental unit or primarily engaged in any of the following North American Industry Classification System (NAICS) codes beginning with: 112XXX Animal Production or Aquaculture. ~7).j>A^-?Jg Program Sponsor.

WebSee details for TBD (L10,B2) Grant Hills Road SW, Bemidji, MN, 56601, Lot/Land, bed, bath, , $29,900, MLS 5734016. Please advise your clients that it may take longer to receive their refund as we review and adjust these returns. WebSmall Business Grant Program as well as the information and documentation required to apply, all of which can be found along with the grant application at revenue.wi.gov. The Wisconsin 30-percent or 60-percent long-term capital gain exclusion under sec. <>

Newest Homes for Sale in Wisconsin; Newest Rentals in Wisconsin; The individual or entity must not be on one of the following lists: The business must not be a governmental unit or primarily engaged in any of the following North American Industry Classification System (NAICS) codes beginning with: 112XXX Animal Production or Aquaculture. ~7).j>A^-?Jg Program Sponsor.  To be eligible, ALL of the following must be met: The application should take approximately 15 minutes and must be completed in one session.

To be eligible, ALL of the following must be met: The application should take approximately 15 minutes and must be completed in one session.

Change).  The SBA limited the grant amount to $1,000 per employee, up to a total of $10,000, for eligible businesses. Sold Price. Change), You are commenting using your Facebook account. Email | Visit website, DENNIS LAWRENCE

The SBA limited the grant amount to $1,000 per employee, up to a total of $10,000, for eligible businesses. Sold Price. Change), You are commenting using your Facebook account. Email | Visit website, DENNIS LAWRENCE  Income received from the State of Wisconsin under the Farm Support Program is exempt from Wisconsin income tax. Are there grants available for my business? WebIf you believe your application was denied in error, you must contact us at [email protected] or (608) 266-2772.

Income received from the State of Wisconsin under the Farm Support Program is exempt from Wisconsin income tax. Are there grants available for my business? WebIf you believe your application was denied in error, you must contact us at [email protected] or (608) 266-2772.

West Central Wisconsin Regional Planning Commission 3 0 obj

We have no control over the nature, content and availability of those sites. Taxpayers may exclude from income emergency grants of economic injury disaster loans (EIDL) and targeted EIDL advances. For this criterion, real and tangible personal property owned by the business is valued at its original cost, and real and tangible personal property rented by the business is valued at an amount equal to the annual rental paid by the business, less any annual rental received by the business from sub-rentals, multiplied by 8. The following chart provides updated 2020 calendar-year Wisconsin tax return due dates as a result of IRS Notice 2021-21: Form. !QA%P7F:F30a

q8Rlt7[!(NX In this 10-county region (Ashland, Bayfield, Burnett, Douglas, Iron, Price, Rusk, Sawyer, Taylor, Washburn), grant awards will not be approved or made to a business who hasn't opened yet due to renovation needs. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); If you received a letter from the IRS or the state of Wisconsin, please make that letter available to us as soon as possible. The following income is exempt from Wisconsin income and franchise tax: Income received from the state of Wisconsin with money received from the coronavirus Wisconsin law also follows the federal law regarding the tax treatment of income and expenses relating to certain federal grants, loans, and subsidies. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them. At least 75% of the businesss value of real and tangible personal property owned or rented and used by the business is located in Wisconsin. Click to share on Facebook (Opens in new window), Click to email a link to a friend (Opens in new window), Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, https://tap.revenue.wi.gov/WITomorrowGrant/, https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#2. Are "gig workers" and other independent contractors eligible?

This is a non-negotiable requirement in NWRPC's administration of this grant. SVAs Biz Tips are quick reads on timely information sent to you as soon as they are published.

This is a non-negotiable requirement in NWRPC's administration of this grant. SVAs Biz Tips are quick reads on timely information sent to you as soon as they are published.  At least 75% of the business's value of real and tangible personal property owned or rented and used by the business is located in Wisconsin.

At least 75% of the business's value of real and tangible personal property owned or rented and used by the business is located in Wisconsin.

Each corporation within a federal consolidated group or a Wisconsin combined group may qualify independently of each other and apply separately for the grant (see Question 16). endobj

608.785.9396 If the two businesses are separately owned and operated by each spouse, and each business separately meets the eligibility criteria, each spouse may qualify for a grant. WebThe Wisconsin Department of Revenue (DOR) and the Wisconsin Economic Development Corporation (WEDC) have collaborated to develop a program to aid small businesses

Kentucky Tattoo Laws For Minors,

You Choose Nick Sharratt Pdf,

Articles C

Elections. (LogOut/ How long will the application take to complete? The program is administered by the Wisconsin Copyright 2023 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA, Wisconsin Tomorrow Small Business Recovery Grant, Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#10. Contact: GovPress@wisconsin. Are payments from the Wisconsin Tomorrow Small Business Recovery Grant program taxable income? Errors must be resolved within 30 days of receipt of this letter." The CAA states that while some states may treat forgiven loan proceeds and their corresponding deductions differently, PPP loan proceeds will not be reported on a Form 1099 and will not be reported on the borrowers federal income tax return. To resolve errors submitted on your application, call (608) 266-2772 or email

If the business is an LLC that files its own federal income tax return as a partnership or corporation, the LLC should apply using the LLC's name and FEIN that it uses to file its federal tax return (e.g., Form 1065, 1120, or 1120-S. Each LLC business is eligible for a grant if the LLC files a separate federal income tax return from its owner. Gambling losses are indirectly deductible on your income tax return in the state of Wisconsin. WEDC will contract with approved entities to distribute and administer these grants in their respective geographic areas of the state. Email | Visit website, DAVE BONIFAS WebSee details for TBD (L12,B12) Grant Hills Road SW, Bemidji, MN, 56601 - Miss, Lot/Land, bed, bath, , $35,900, MLS 5734044. This means that you will be required to pay taxes on these funds.

Elections. (LogOut/ How long will the application take to complete? The program is administered by the Wisconsin Copyright 2023 SVA Certified Public Accountants | Privacy Policy | Cookie Policy | CCPA, Wisconsin Tomorrow Small Business Recovery Grant, Wisconsin Department of Corrections Sex Offender Registry, Wisconsin Department of Workforce Development Debarred Contractors List, Wisconsin Department of Administration Ineligible Vendors Directory, https://www.revenue.wi.gov/Pages/TaxPro/2021/WisconsinTomorrowSmallBusinessRecoveryGrant.aspx#10. Contact: GovPress@wisconsin. Are payments from the Wisconsin Tomorrow Small Business Recovery Grant program taxable income? Errors must be resolved within 30 days of receipt of this letter." The CAA states that while some states may treat forgiven loan proceeds and their corresponding deductions differently, PPP loan proceeds will not be reported on a Form 1099 and will not be reported on the borrowers federal income tax return. To resolve errors submitted on your application, call (608) 266-2772 or email

If the business is an LLC that files its own federal income tax return as a partnership or corporation, the LLC should apply using the LLC's name and FEIN that it uses to file its federal tax return (e.g., Form 1065, 1120, or 1120-S. Each LLC business is eligible for a grant if the LLC files a separate federal income tax return from its owner. Gambling losses are indirectly deductible on your income tax return in the state of Wisconsin. WEDC will contract with approved entities to distribute and administer these grants in their respective geographic areas of the state. Email | Visit website, DAVE BONIFAS WebSee details for TBD (L12,B12) Grant Hills Road SW, Bemidji, MN, 56601 - Miss, Lot/Land, bed, bath, , $35,900, MLS 5734044. This means that you will be required to pay taxes on these funds.  We teach, learn, lead and serve, connecting people with the University of Wisconsin, and engaging with them in transforming lives and communities. 3.

We teach, learn, lead and serve, connecting people with the University of Wisconsin, and engaging with them in transforming lives and communities. 3.

The individual or entity filed its 2019 federal and Wisconsin income or franchise tax return (see exception in Question 18). 2. Who is eligible and what are the eligible use of funds?

The individual or entity filed its 2019 federal and Wisconsin income or franchise tax return (see exception in Question 18). 2. Who is eligible and what are the eligible use of funds?  WebSee details for TBD (L10,B2) Grant Hills Road SW, Bemidji, MN, 56601, Lot/Land, bed, bath, , $29,900, MLS 5734016. Please advise your clients that it may take longer to receive their refund as we review and adjust these returns. WebSmall Business Grant Program as well as the information and documentation required to apply, all of which can be found along with the grant application at revenue.wi.gov. The Wisconsin 30-percent or 60-percent long-term capital gain exclusion under sec. <>

Newest Homes for Sale in Wisconsin; Newest Rentals in Wisconsin; The individual or entity must not be on one of the following lists: The business must not be a governmental unit or primarily engaged in any of the following North American Industry Classification System (NAICS) codes beginning with: 112XXX Animal Production or Aquaculture. ~7).j>A^-?Jg Program Sponsor.

WebSee details for TBD (L10,B2) Grant Hills Road SW, Bemidji, MN, 56601, Lot/Land, bed, bath, , $29,900, MLS 5734016. Please advise your clients that it may take longer to receive their refund as we review and adjust these returns. WebSmall Business Grant Program as well as the information and documentation required to apply, all of which can be found along with the grant application at revenue.wi.gov. The Wisconsin 30-percent or 60-percent long-term capital gain exclusion under sec. <>

Newest Homes for Sale in Wisconsin; Newest Rentals in Wisconsin; The individual or entity must not be on one of the following lists: The business must not be a governmental unit or primarily engaged in any of the following North American Industry Classification System (NAICS) codes beginning with: 112XXX Animal Production or Aquaculture. ~7).j>A^-?Jg Program Sponsor.  To be eligible, ALL of the following must be met: The application should take approximately 15 minutes and must be completed in one session.

To be eligible, ALL of the following must be met: The application should take approximately 15 minutes and must be completed in one session.

The SBA limited the grant amount to $1,000 per employee, up to a total of $10,000, for eligible businesses. Sold Price. Change), You are commenting using your Facebook account. Email | Visit website, DENNIS LAWRENCE

The SBA limited the grant amount to $1,000 per employee, up to a total of $10,000, for eligible businesses. Sold Price. Change), You are commenting using your Facebook account. Email | Visit website, DENNIS LAWRENCE  Income received from the State of Wisconsin under the Farm Support Program is exempt from Wisconsin income tax. Are there grants available for my business? WebIf you believe your application was denied in error, you must contact us at [email protected] or (608) 266-2772.

Income received from the State of Wisconsin under the Farm Support Program is exempt from Wisconsin income tax. Are there grants available for my business? WebIf you believe your application was denied in error, you must contact us at [email protected] or (608) 266-2772.

This is a non-negotiable requirement in NWRPC's administration of this grant. SVAs Biz Tips are quick reads on timely information sent to you as soon as they are published.

This is a non-negotiable requirement in NWRPC's administration of this grant. SVAs Biz Tips are quick reads on timely information sent to you as soon as they are published.  At least 75% of the business's value of real and tangible personal property owned or rented and used by the business is located in Wisconsin.

At least 75% of the business's value of real and tangible personal property owned or rented and used by the business is located in Wisconsin.